Working: 8.00am - 5.00pm

Working: 8.00am - 5.00pm

Active duty service members with 20 or more years of service are eligible for retirement benefits, which may include monthly retired pay, survivor benefits, and access to the Thrift Savings Plan (TSP.

Members with 20 or more years of active service are generally eligible for retirement.

There are three main active-duty retirement plans: the Final Pay plan, the High-36 Month Average plan, and the REDUX plan (Military Retirement Reform Act of 1986). The Blended Retirement System (BRS) combines elements of the legacy system with a defined contribution component.

Reserve component members can also retire with benefits after accumulating 20 or more qualifying years of service, typically becoming eligible for retired pay at age 60.

Retired pay is calculated based on years of service and basic pay at retirement, with adjustments for cost-of-living.

The SBP provides annuity payments to eligible survivors of deceased retirees.

This system includes a defined benefit (retired pay), a defined contribution component (Thrift Savings Plan), and a one-time continuation pay.

A defined contribution plan where the government matches contributions, similar to a 401(k).

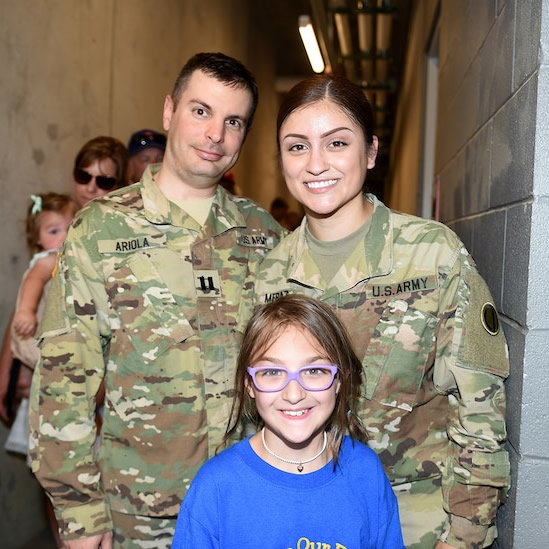

The Army, for example, has a Retirement Services Program to assist service members and their families in preparing for and transitioning to retirement.